The following analysis is a part of a research by Thodoris Koutsovoulos (co-founder) on 2018 for MBA final dissertation (CCCU) with subject : Innovation and new product development in spirits market

SPIRITS MARKET AND CONSUMPTION PATTERNS

This chapter presents an overview of the alcohol consumption patterns and spirits market trends in Greece and abroad. Why, how and when do people drink? What do these behavioral patterns mean for new product development into spirit market? Which are the main trends and challenges of the spirits market in Greece and abroad? Is there any room for innovative spirits products?

Alcohol consumption patterns: Empirical evidence

Recent consumer surveys focusing on spirit market point out that a) cocktails are playing a crucial role in the ongoing success of spirits market and b) innovation can boost cocktail sales (CGA, 2019). More than 58% of spirit drinkers participated in the above mentioned survey in UK declared that they are willing to try new brands. Spirits and alcohol industry is to a large extent driven by the new product development processes, getting effort to motivate consumers to try different variants. However, according to the findings of a global survey conducted in 2015 regrading alcohol consumption in UK, Australia, China, Germany, India and US, most consumers and especially older ones are less likely to consume a different alcoholic drink. 68% of those participated in the survey declared that they prefer to drink and buy one or two favorite products at all times (Maxus, 2015). On the other hand, the same survey reveals that younger drinkers (aged under 35 years old) are more likely to experiment with new drinks. Furthermore, more and more people tend to “have a casual drink at home”, even though social drinking remains the most popular alcohol occasion. Friends/ family, atmosphere/mood and the presence of food are being the consumers’ top three key ingredients for a great occasion. Alcohol occasions are still frequent, with the most frequent drinking occasions are at home, enjoying a drink before a night out, social occasions at home and family gatherings. As the report points out “people like ritual in their drinking experience and this raises an interesting opportunity for marketers around the off-trade to create meaningful brand experiences that move beyond the traditional price/value proposition”. Moreover, price of the new product seems to be a decisive factor in drink choice, even though the quality and taste of alcohol remains more important compared to price (ibid). Empirical evidence suggests that the factors related with the alcohol choice and consumption are changing and should be taken into account in new product development and management processes.

Greek market’s economic and demographic trends: A changing but still alive market

Capital control issues that stuck the market in 2015 had been gradually being resolved till September 2018, resulting in some stability. The 3rd economic adjustment program for Greece had been running from 19 April 2015 till 20 August 2018. In total, Greece received €61.9 billions of financial assistance by the ESM, out of a total program envelope of up to €86 billions. The purpose of the program was a secure return to sustainable economic growth in Greece (European Council Council of the European Union, 2018). However, taxes continue to increase as the government tries to pull Greece out of the economic crisis. Higher taxes and more expensive retail prices harm the Greeks people who have seen their personal finances and purchasing power decimated (Campion, 2017).

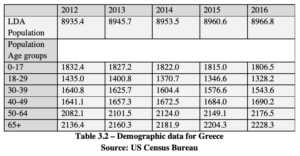

Greece’s mortality rate is higher than its birth rate, meaning that the legal-drinking age

(LDA) population is shrinking. As a direct result of Greece’s economic turmoil, a considerable number of people are leaving the country and moving to Western Europe. It is estimated that half a million people have left Greece since 2009. The population has fallen below 11m (Campion, 2017).

In IWSR report 2016 for Greece is mentioned that two consumer trends emerged during that year which changed the market dramatically. As the available income is further shrinking, Greek consumers have begun to make far fewer visits to on-trade channels (Campion, 2017). Those who previously went out in bars and clubs several times a week, they are able to go out once a week and mainly during the weekend. Traditional on-trade categories such as vodka and tequila have declined significantly in mainland Greece but are kept steady due to the increase in consumption in Greek islands where the number of tourists increased due to security concerns in neighboring Turkey. In the same report it is noticed that because nights out are becoming less of a habit and more of a treat, Greek consumers are getting more open to experimentation with new brands and categories. They also look to prefer more expensive brands. As a result of this new behavior, predominantly on-trade categories remain in decline, although super and ultra-premium segments are growing strongly. Secondly, it is mentioned that as most people can generally now only afford to have dinner at home, there is a trend towards nights out that start and end earlier (Campion, 2017). This trend could be seen as an opportunity for the development of new products or services, focusing on “home drinking”. Greece is beginning to adopt the Western European culture of after-work drinks, known as early drinks. This has particularly benefited lower-ABV categories such as wine and beer. The recent clampdown on drink-driving has also led to more consumers switching to wine and beer. The companies that are able to stay in business are using this fallow period to position themselves for when the market starts to recover (Campion, 2017). Amvyx SA took over Bacardi’s portfolio, and Campari’s brands have moved to Coca-Cola Hellenic. The wine and spirits market in Greece is expected to consolidate further in 2019. The IWSR forecasts that smaller companies will go out of business and the larger companies will take their market share.

Global Market

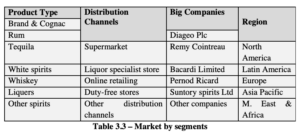

The supermarkets & hypermarkets dominated the global beverage market and distribution channels in 2017. When consumers visit supermarkets & hypermarkets for their everyday needs they could possibly buy alcoholic drinks; it has become a usual and convenient choice. The liquor Specialist Stores had the 2nd largest revenue share the same year. The on-trade (bars, night clubs, hotels, restaurants) distributors are also included in this category. In many developing countries the modernization has transformed the lifestyle of people. It has fueled the nightclub and bar culture and, as a result, the alcohol consumption. Additionally, the Online retailing activity will possibly grow highly over the next years. The main factors that make the growth of the market curtailed are the restrictions on advertising of alcohol, heavy taxation, tough rules and regulations globally, health issues and easy approachable substitutes. In addition, the increased ubiquity of counterfeiting or illicit alcohol will probably affect the market negatively. On following table, the market has been segmented based on distribution channels, types of the products, big companies and geographical regions.

The tough competition among the big companies lead to a strategy based on mergers and acquisitions aiming to the expansion of consumer base and upgrading the position in the market. Pernod Ricard, for example, completed the acquisition of the remaining stake in Avión Spirits LLC from its joint-venture partner Tequila Avión in January 2018; the late was the owner of the ultra-premium tequila brand Avión. Likewise, Diageo has concluded a definitive agreement to acquire the tequila brand Casamigos, which were co-founded by George Clooney, in a deal that amounts up to $1 billion in June 2017. Relevant literature on the global alcoholic spirits market reveals the following: a) an increasing number of marketing and promotional activities of vendors lead the global market, b) premium spirit brands are in higher demand than low-priced value ones, c) more mergers and acquisitions or strategic synergies among various players in the market are enhancing the market growth, d) bigger players are acquiring smaller ones so as to upgrade their position in the market ranking share and e) a major challenge that hinders market growth is the campaigns against alcohol consumption by various organizations around the world. The global spirits industry is typically associated with international big brands that are sold all over the world and are backed by multimillion-dollar marketing budgets (Micallef, 2018). These are the spirits brands that one typically finds stocked in bars all over the world. According to the International Wine & Spirits Research (IWSR) group, however, the world spirits market is remarkably local, with national brands holding 9 of the top 10 spirit categories by volume. Only Smirnoff vodka, among the international brands, at number 6 (25.6 million cases), made it into the top 10 spirit brands.

The ten world’s best-selling spirits brands in 2017 are the following:

1 . Jinro, a Soju, a Korean alcoholic drink typically made from rice or sweet potatoes, owned by Hite-Jinro. (75.9 million 9-liter cases),

2 . Thai beverage Ruang Khao, a cane spirit (31.75 million cases),

3 . Officer’s Choice, an Indian whisky owned by ABD (31.5 million cases),

4 . Emperador, a Philippine brandy owned by Emperador (28.7 million cases),

5 . McDowell’s, an Indian whisky owned by Diageo, (26.3 million cases),

6 . Smirnoff, vodka owned by Diageo (25.6 million cases),

7 . Chum Churum, a Korean Soju brand, owned by Lotte, (25.5 million cases),

8 . Hong Tong, a Thai cane spirit owned by Thai Beverage, (21.2 million cases),

9 . Imperial Blue, an Indian whisky owned by Pernod Ricard, (18.8 million cases),

10 . Good Day Soju, a Korean brand, (18.5 million cases)

It is forecasted that during the period of 2018-2026 the growth will reach at a CAGR of 3.36% for the international alcoholic beverage market, compared to 2017 (InkWood research, 2017). The market advancement looks rational because of the following factors: alternative alcohol consumption habits and lifestyle, preferred drink traditional, rapid urbanization, high disposable income, e – commerce and premiumization .

Alcohol consumption in Europe

According to the Institute of Alcohol Studies, the average UK citizen consumed 10.2 liters of alcohol (defined as spirits, wine or beer) per head in 2010. The highest consumption of alcohol, with more than12 liters per adult in 2010 were reported in Austria, France, Latvia, Lithuania, Luxembourg and Romania. At the bottom of the scale, Cyprus, Greece, Italy, Malta (mainly southern European countries) have relatively low levels of consumption, 7 to 8 liters of pure alcohol per adult.

sources

Bryant, C., 2018. mintel.com. [web] http://www.mintel.com/press-centre/food-and- drink/the-stay-at-home-generation-28-of-younger-millennials-drink-at-home-because- it-takes-too-much-effort-to-go-out Business Review, May/June 1987, pp 43–59.

Campion, J., 2017. s.l.: IWSR.

European Union. [web] ://www.consilium.europa.eu/en/policies/financial- assistance-eurozone-members/greece-programme/ (8/9/2018)

CGA (2019) BrandTrack consumer survey. UK: CGA.

InkWood research, 2017. Global alcoholic spirits market forecast 2018 – 2026, s.l.: InkWood research.

Maxus (2015) The Drinking Code. UK: Maxus

Micallef , J. V., 2018. The International Spirits Market Is Remarkably Local, s.l.: forbes.com.